QR Project

Sunday, March 12, 2017

Startup Funding Explained

Startup Contract Explained

Malaysia's Cradle Fund is shifting towards equity funding, launches new service to help achieve this goal

Cradle Fund is moving away from grants; ‘Direct Equity 800’ will invest around US$70,000 to US$180,000 in early-stage startups

Cradle Fund Sdn Bhd, an agency under Malaysia’s Ministry of Finance, announced this week the launch of an investment product called Direct Equity 800 (DEQ800) that is built to help startups receive cash injections of between RM800,000 (US$180,000) and RM300,000 (US$67,000).

The strategy behind DEQ800 is to slowly wean early-stage Malaysian startups off of government grants. According to Cradle Group CEO Nazrin Hassan, about half of Cradle’s budget for 2017 will be equity-funding while the other half will be in grants. Longterm, Cradle hopes to gradually shift away from grants and towards the equity model.

The decision comes on the heels of a February initiative from Cradle to expand its portfolio. Cradle will target a wide-range of industries — like fintech or oil, gas and energy. But, the company must be a tech-based startup.

Hassan said he hopes DEQ800 will become an alternative option early-stage startups consider when they are going on the fundraising path. The agency plans to invest in 10 companies and close three co-investment deals in 2017.

“We believe DEQ800 will serve as a crisp avenue for start-ups with clear growth and good exit potentials at pre-seed and seed stages to raise capital for their businesses and help achieve these objectives,” said Hassan in a statement.

The co-investment strategy

Cradle’s co-investment strategy strategy is also being tweaked.

Previously, Cradle would match the amount being invested from their partners. Now, Cradle will double the money being invested by their partners.

The 2-to-1 model will be introduced along with a bump in the ticket size. Previously, Cradle would invest RM500,000 (US$112,000); now the amount will be RM800,000 (US$180,000).

‘‘One major advantage of getting seed funded by Cradle is that our start-ups can look forward to leverage our ecosystem of diversified investor groups which can add value to their knowledge and experience as they strive to scale beyond their home market,” said Hassan.

Cradle Fund also has a subsidiary called Cradle Seed Ventures that was launched in June, 2015.

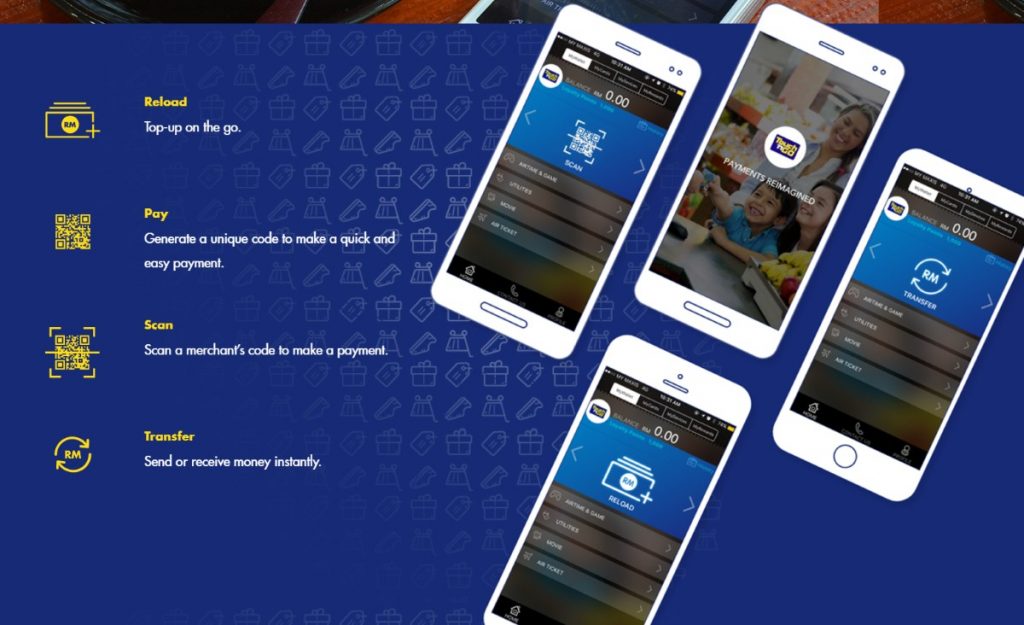

Touch ‘N Go Wallet App Goes Into Beta Test : Doesn’t Support Public Transportations and Tolls Though

Last year, Touch ‘N Go (TnG) has mentioned its plan to come out with a digital app within the first quarter of 2017. Thanks to our tipster, we now have learned that the company has begun testing the app which is called Touch ‘N Go Wallet for users in Taman Tun Dr. Ismail, Kuala Lumpur.

However, TnG Wallet is not the mobile extension of the usual TnG cards that many of us owned. In fact, they are separate products altogether as users not able to utilize the credit balance within their TnG cards through TnG Wallet which has a separate credit reload mechanism of itself.

Furthermore, TnG Wallet doesn’t share the same credentials as MyTouchnGo Portal (commonly used to manage TnG cards) and users are required to register a separate account for it. Additionally, the TnG Wallet app can’t be used for public transportation fares, toll charges, and parking payments.

So, what users can actually do with the TnG Wallet app then? According to the FAQ on the service’s official website, it can be used to top-up prepaid accounts, and utility bills payment as well as tickets from MBO Cinemas, and airline bookings through Airpaz – all from within the app itself.

Other than that, users are also able to use TnG Wallet as payment method at selected merchants within Taman Tun Dr. Ismail. Do note that TnG has choose to implement QR code-based system for its TnG Wallet instead of NFC which might seems rather primitive and baffling given that the company already has experience with NFC since as early as 2012 but this should enable the app to be used on a wide variety of devices rather than being restricted to just smartphones with NFC.

Last but not least, users are also able to transfer funds from their TnG Wallet balance to another user. Not to forget, the service also has its own loyalty program where users can obtain rewards through points that they accumulated from purchases using TnG Wallet.

The website stated that the live trial at TTDI will last until 20 April 2017 and residents within the area are welcomed to participate in the test by registering their details over here. All in all, it is a rather interesting venture by TnG but might open to confusion as users might deemed TnG Wallet as an app that can be used with their TnG cards rather than a totally separate payment tool.

(Source: TnG Wallet’s Official Website. Thanks for the tips, Aizzamil Rushaidir!)

Subscribe to:

Posts (Atom)